High quality and now even lower cost: You can have both

Vanguard asset allocation solutions offer a simple, effective way to invest in global markets. Whether you opt for a single low-cost ETF, Mutual Fund, or Model Portfolio, you gain access to a balanced portfolio of equities and bonds from around the world.

The choice is yours: simply decide which asset mix and format aligns with your risk tolerance and preferences.

A solution for everyone

Our industry-leading asset allocation ETFs – accessible to all investors and advisors.

Asset Allocation ETFs

Asset Allocation ETF Mutual Funds

Asset Allocation Model Portfolios

Advisors, free up your time to build relationships with your clients and leave portfolio management and rebalancing to one of the largest multi-asset managers in the world.

Invest in nearly all the companies you know, with a professionally managed single-ticket solution.

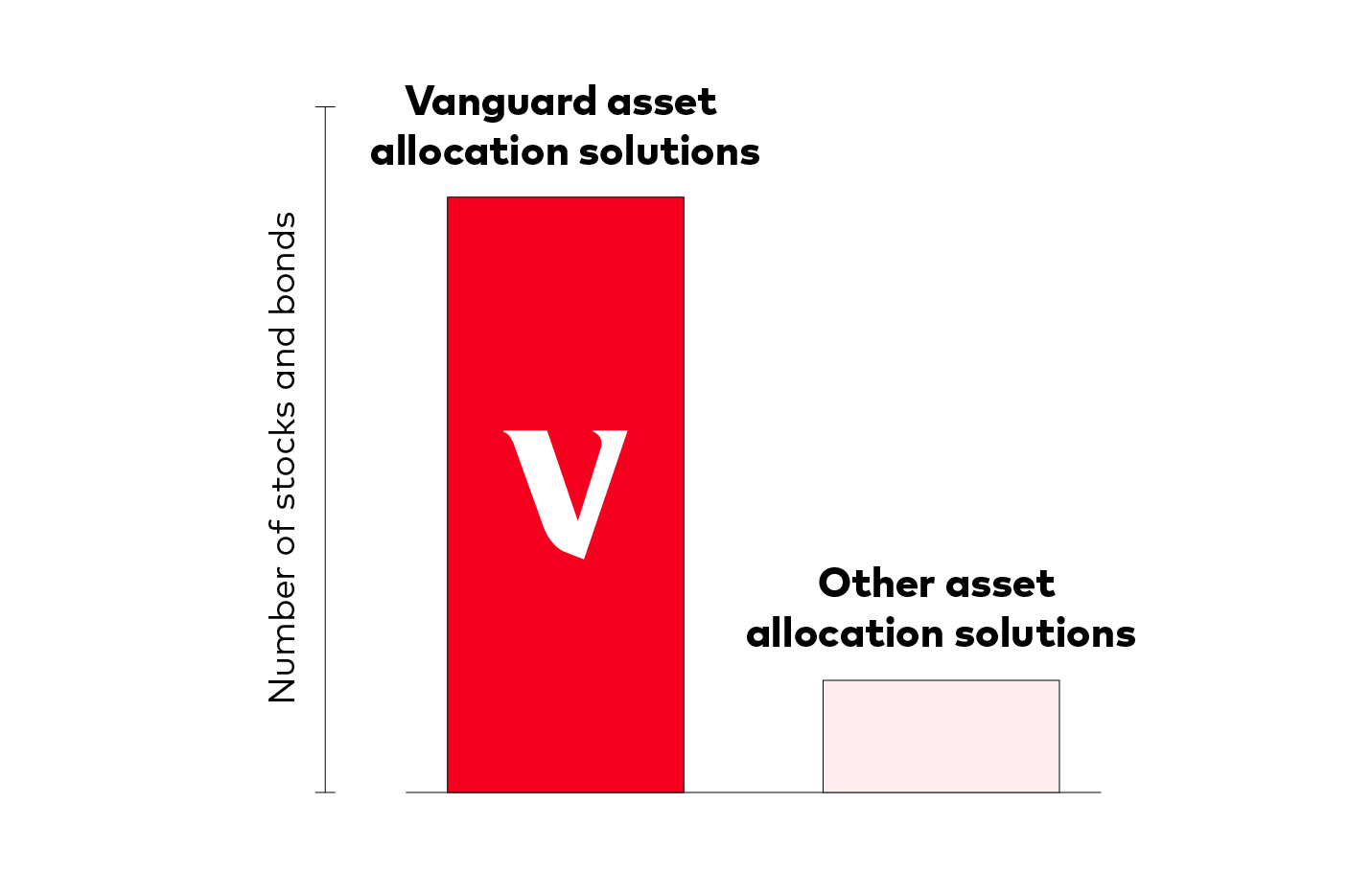

Vanguard’s asset allocation solutions are the most diversified investment solutions in Canada. Each of our asset allocation products holds more than 13,000 underlying large, mid- and small-cap stocks and over 19,000 high quality bonds, reducing risks and harnessing the full potential of indexing.

All-in-one multi-asset solutions to meet your investment needs

Low costs can supercharge your investment returns

It’s a simple yet powerful principle: keep your investment costs to a minimum, and over the long term, your savings really add up, making a significant impact on your overall investment returns. See for yourself how much you can save over 10, 20 and 30 years by investing in Vanguard Asset Allocation ETFs, which cost up to 75%* less than the industry average.

*As of November 18, 2025, Vanguard's average management expense ratio is estimated to be 0.19% following the management fee cuts for the Vanguard asset allocation ETFs from 0.22% to 0.17%. Industry average expense ratio: 0.82%. Industry averages exclude Vanguard. Sources: Vanguard and Morningstar, Inc., as of September 2025. Results shown are not guaranteed. There may be other material differences between investment products that must be considered prior to investing. This hypothetical illustration assumes a 6% return for all examples with a starting investment of $100,000. Rate is not guaranteed. If the rate of return were altered, results would vary from those shown. The final balance shown is after costs. This example doesn't represent any particular investment and doesn't account for inflation. There may be other material differences between investment products that must be considered prior to investing.

Rebalancing done for you

Instead of monitoring and manually rebalancing your investments yourself, let Vanguard's team of over 100 investment professionals do it for you. Our Asset Allocation solutions are actively monitored and efficiently rebalanced, saving you time and effort in ongoing portfolio management.

With different equity-to-bond mixes that are regularly rebalanced back to the target allocation, advisors and investors simply need to choose the most suitable mix for their investment goals.

Advisors: Focus on your clients, leave the rest to us

Our research suggests clients greatly value the uniquely human skills advisers offer, as well as their emotional support and guidance through sometimes difficult market conditions.

At the same time, advised clients tend to favour automation for portfolio related tasks such as asset allocation and rebalancing1.

This is the beauty of our multi-asset solutions. Once you've decided which one suits your client's goals and appetite for risk best, you can leave the portfolio tasks to us, and focus on what they really want from you; your advice and guidance.

Access research findings and advisor resources

1 Source Vanguard. See P. Costa and J. E. Henshaw, 2021: “Quantifying the investor’s view on the value of human and robo advice.”