We're well known for our strength in passive investing but we've been leaders in active since our founding 50 years ago.

View Active funds$1.8T* Active assets under management

Vanguard manages more money in active strategies globally than the size of the Canadian mutual fund industry

50 Years of experience

We have managed active funds since our inception in 1975, and in Canada since 2018

Famously low fees, leaving investors with more

In Canada, on average, our management fees are 22.5%** lower than the industry average F series management fee.

The more we grow, the more you and your clients save

Since 1975, Vanguard has been consistently lowering the average expense ratio for our clients around the globe. As our assets grow, we lower our costs, meaning your clients save more of what they earn.

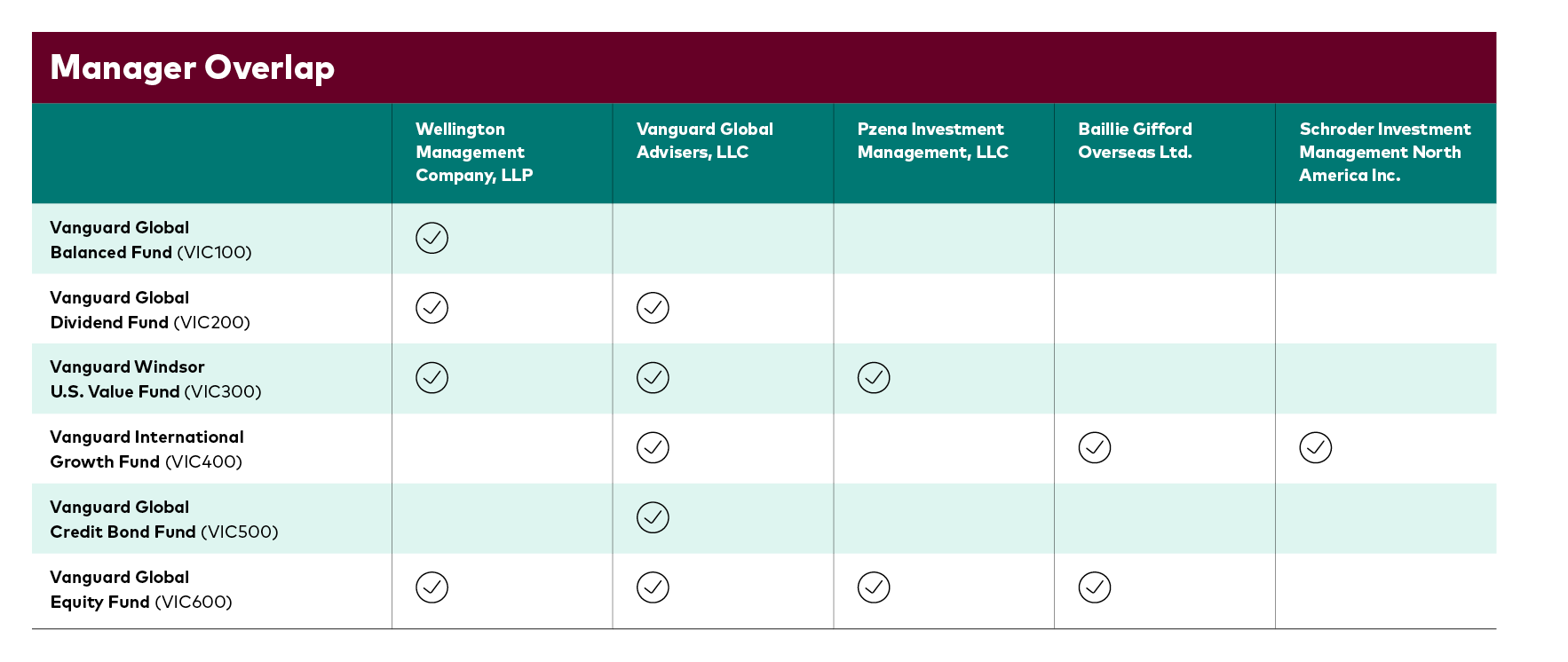

We partner with industry-leading investment managers

$6.6B* Average mandate size of our external active sub-advisors

We work with proven managers who sub-advise our active strategies

14 Years

Average tenure of our sub-advisor relationships

25 External sub-advisors

For our global active lineup

Our Investment Managers

Wellington Management

Tracing its history to 1928, Wellington is one of the world’s largest independent investment management firms, serving as a trusted adviser to over 2,400 clients in more than 60 countries.

Baillie Gifford

Baillie Gifford is an independently owned investment management firm. It is owned and run by 39 of its senior executives who operate as a partnership, a structure which has endured for over a century, and which provides stability for clients and motivation for employees.

Schroders

Schroders is an investment manager with broad expertise across public and private markets, investing on behalf of savers and investors globally.

Pzena

Pzena's investment philosophy is simple: seek to buy good businesses at low prices. Pzena focuses exclusively on companies that are underperforming their historically demonstrated earnings power, performing fundamental, bottom-up research on these companies in an effort to determine whether the problems that caused the earnings shortfall are temporary or permanent.

Our enduring multi-manager approach

We employ a well-defined process to select world-class investment talent with differentiated investment philosophies. And, by combining managers with distinct — but complementary — investment philosophies in our funds, we are less dependent on any one manager, investment style, or market environment to deliver results.

Explore our Active Strategies

Reasons to invest

- Time-tested balanced global strategy designed to mirror the world’s oldest balanced fund launched in 1929

- Equities actively managed following a capital cycles approach: investing globally in conservatively valued, industry-leading companies with improving prospects

- Fixed income approach based on both macro and security level research in global investment grade bonds, to offer income and stability to the portfolio

Investment objective

The fund seeks to achieve its investment objective by investing primarily in a combination of equity securities of companies (approximately two-thirds of the portfolio) and fixed income securities (approximately one-third of the portfolio). The fund’s holdings may be selected from all economic sectors and industry groups, and located anywhere in the world, providing exposure to a broad range of developed and emerging markets. The fund employs an active management strategy. Its independent sub-advisor follows a distinct approach in managing the fund’s assets to maintain a balance between its equity and fixed income components.

* USD

**The average management fee is calculated by taking the average management fee of the industry for series F funds. Vanguard is lower than 22.5% of the industry when compared to the maximum fee for VIC600 of 0.55.

Contact us

If you have questions or would like more information, please contact your Vanguard sales representative or visit our contact us page.

Contact us